Contents

Popular approaches to trading the Canadian dollar as the base currency often involve either the Japanese Yen or the euro (the CAD/JPY or EUR/CAD pair). These currency pairs are popular with investors in Canada due to their correlation to the price of oil. Canada is a major producer of oil and Japan is a major importer, thus the CAD/JPY pair can be affected by the price of oil. Similarly, the price of Canadian oil itself can be influenced by the CAD/JPY rate.

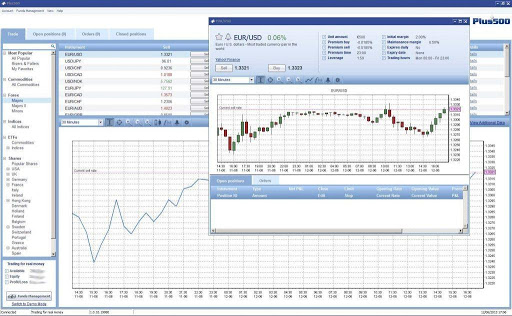

For example, EUR/USD’s spread is usually around 0.9 pips, and USD/JPY’s spread is usually about 1.1 pips. If you are based in Canada and wish to begin trading the forex market, you must choose a safe and reputable broker to trade with. These days there are so many brokers to choose from, so it’s understandable a daunting prospect trying to decide which option is best for you and your investment situation. For traders who demand more from their brokers, they have the choice of the VIP trading account. This type of trading account typically requires a minimum investment which runs into tens of thousands of dollars. They also normally come with a dedicated account manager to handle the trader’s requests.

TMGM – Best Forex Broker In Canada

You should be aware that you may lose a significant portion of your portfolio. The Investment Industry Regulatory Organization of Canada is the national self-regulatory organization which oversees all investment dealers and trading activity on debt and equity marketplaces in Canada. AvaTrade is able to offer trading opportunities to Canadian residents due their Collaboration with Friedberg Direct in Canada.

This longer-term trading strategy involves looking for established directional movements called trends and then establishing positions along with the trend until its conclusion. Volatility risk.Volatility or variability are the changes in price quotes over a period of time. Opening or closing a position as prices move up or down can be more challenging when volatility is high and price swings are wider. Eightcap charges a $3.50 charge per trade on top of the dealer spread. Users can take advantage of the platform that best suits their needs, as well as incorporates automated trading for the more advanced programmers. The U.S. dollar is the baseline currency in everything from commodities to stocks.

The chances that a broker goes bankrupt or if the mother company is liquidated are quite considerable. However, up to this moment, these efforts have not been fruitful yet, and the Canadian Forex brokers are still reporting to the different regional authorities. Spot opportunities, trade and manage your positions from a full suite of mobile and tablet apps. Consequently, the relative value of a currency changes over time when compared to another currency. We’ll ask for some personal Start your registration online or via the OFX app.

Friedberg Direct [Powered by AvaTrade]

Governments that are more reliable garner premiums, where riskier government currencies will trade at discounts. Interest rates.Central banks and governments use interest rates as a way to increase and decrease money supply within the economy. Since the exchange rate between two currencies is derived from the supply and demand of each currency, changes in the interest rate can result in movements higher or lower in the currency pair pricing. If you tried to chart price movement from your broker of a forex pair, it wouldn’t show any volumes. Foreign exchange trading, often referred to as forex, is the exchange from 1 currency to another. If you’ve ever been at an international airport, you’ll see kiosks where you can exchange one currency for another.

Add to that, since the regulated Forex brokers in Canada are licensed by regional and territorial agencies, it could get confusing regarding the future of the regulations. This encourages many FX brokers to go offshore, in more clear and stable regulatory conditions. It might come to the surprise of some that there are undeniable advantages for Forex trading in Canada, and many FX investors are considering moving their funds to Canadian-based brokers.

If you want the best Forex broker in Canada, make sure they are regulated by IIROC and are covered by the CIPF. Forex typically involves interest paid or received when holding positions for longer than a day. This is incompatible with Islamic finance principles, so Islamic Forex accounts were created to meet this gap in the market. These types of accounts replace the variable interest charge with a fixed charge for overnight positions or no charge at all thereby making currency trading compatible with Islamic finance principles. In an effort to protect Canadians, the Canadian Federal Government has enacted one of the strictest regulatory bodies in the world when it comes to offering investment platforms that target Canadian residents. The standards for international firms to offer forex type services are very strict.

Also, many Forex brokers in the US will not accept accounts from Canadian residents. If you are looking for a broker that offers the best currency trading platform in Canada for your trading needs, all the trading platforms offered globally are available from Forex brokers in Canada. For example, MetaTrader 4 and MetaTrader 5 are a standard for many Forex Brokers in Canada. It should not be assumed that the methods, techniques, or indicators presented in these products will be profitable, or that they will not result in losses. Adam Lemon began his role at DailyForex in 2013 when he was brought in as an in-house Chief Analyst. He has previously worked within financial markets over a 12-year period, including 6 years with Merrill Lynch.

She specializes in coverage of personal financial products and services, wielding her editing skills to clarify complex topics to help consumers make informed decisions about their money. If you only trade stocks, options, or funds, then no problem; any broker will service you. However, if you want to trade complex options, forex, or futures, you will need to do your research ahead of time. Connor is a Scottish financial specialist, with a particular focus on wealth management and equity investing. Currently based in Glasgow, Connor writes full-time for a vast array of top financial websites, whilst also providing financial consulting to small start ups.

EURUSD and USDJPY spread is even for mostly 50% of daytrading session. With no commission, it makes trading these currency pairs at no cost at all. Blain Reinkensmeyer has 20 years of trading experience with over 2,500 trades placed during that time. He heads research for all U.S.-based brokerages on StockBrokers.com and is respected by executives as the leading expert covering the online broker industry. Blain’s insights have been featured in the New York Times, Wall Street Journal, Forbes, and the Chicago Tribune, among other media outlets. For casual investors looking for low-cost trades, who are willing to use a broker without all the bells and whistles, CIBC Investor’s Edge is worth considering.

Our research focuses heavily on the broker’s custody of client deposits and the breadth of its client offering. Safety is evaluated by quality and length of the broker’s track record, plus the scope of regulatory standing. Major factors in determining the quality of a broker’s offer include the cost of trading, the range of instruments available to trade, and general ease of use regarding execution and market information. The broker offers an extensive range of assets to trade in which includes more than 60 currency pairs, and other markets for trading stocks, ETFs, crypto, and more. AvaTrade users can also avail of a very strong range of educational content with insightful material to fit all level of traders.

Best Forex Brokers Canada 2021

What makes Canada a gem that attracts investors is the Canadian Investor Protection Fund or CIPF, which compensates the traders if a broker announces insolvency. Unlike many countries, Canada allows Forex brokers abroad to attract investors from Canada without requiring a Canadian regulatory https://forex-reviews.org/ license, and Canadian investors can legally trade with any financial broker. Canada is one of the countries where Forex brokers are highly secure and trustworthy. Unique regulations in the country offer a flexible yet reliable environment for every Forex broker and trader.

Each year, we collect thousands of data points and publish tens of thousands of words of research. Read on the list and choose your best Canada-based forex broker and start your forex trading career the right way with the right broker. Given the differences in regulations between Canadian provinces and territories, some brokers only accept clients from certain regions. Two notable examples are Alberta and Ontario, which both have additional regulatory requirements than other areas. We encourage Canadian investors to double-check this information via a broker’s website or contact them directly online.

Our research team evaluates and monitors dozens of the top regulators in the forex industry. Next, look up the firm name on the Dealer Member section or AdvisorReport module of the IIROC website. Here is the official page for OANDA and results are also available on the CSA’s website which shows each province that the broker can operate in Canada.

- This is the only forex broker on our list that is headquartered in Canada.

- Because of this risk, Canadian forex brokers are recommended to trade only with the best forex brokers in Canada and that’s where we can help you narrow down your selection.

- Firstly, in terms of forex trading, there are more than 90 currency pairs available.

- Currently, there are strict limits on the margin and leverage allowed in Canada, with a maximum of 2.2%.

- Interactive Brokers brings a smart order router and stays on top of changes in market conditions to re-route all or parts of your order.

Our editorial content is independent and unbiased; here’s how we make money. The spread is the difference between the price the broker is willing to buy at and the price the broker will sell at. The broker’s buy rate will be less than the rate they would sell at – and the difference between the two is the spread.

Trading Platforms with OANDA

Variable spreads on the other hand are usually lower than fixed spreads but are susceptible to spikes due to changes in market volatility. AvaTrade is one of the largest Forex / CFD brokers and well-known for offering their clients a choice of fixed or floating spreads. AvaTrade is directly regulated in Ireland , Australia, Japan, South Africa, and the British Virgin Islands. Outside the European Union, Ava offers maximum leverage on Forex currency pairs as high as 400 to 1. AvaTrade offers trading in over 55 different Forex currency pairs, 17 commodities, 20 equity indices, 14 cryptocurrencies, plus 66 individual stocks and shares.

Risk and Forex Trading

I was fortunate enough in my early twenties to have a friend that recommended a Technical Analysis course run by a British trader who emphasized raw chart analysis without indicators. Having this first-principles approach to charts influences how I trade to this day. A mini lot is one-tenth the size of a standard, or 10,000 units of a base currency. One pip of a currency pair based in U.S. dollars is equal to $1.00 when trading a micro lot. For example, if you are in a GBP/USD short trade and the price moves down by 50 pips, the profit is $50 for every mini lot you have traded. There is a great deal of choice amongst Canadian Forex brokers from account types, trading platforms, trading software, and margin requirements.

One major aim of Forex market regulation is to ensure client protection. In this line of thought, similar to other regulatory bodies across the globe (FCA, ASIC, CySEC, etc.), IIROC enforces a system of rules aimed to prevent the insolvency of brokers it regulates. In this section, our team of experts will try to outline what are some IIROC duties and how they can benefit Canadian traders.

TMGM has world-class customer service and education

DailyForex.com adheres to strict guidelines to preserve editorial integrity to help you make decisions with confidence. Some of the reviews and content we feature on this site are supported by affiliate partnerships from which this website may canadian forex brokers receive money. This may impact how, where and which companies / services we review and write about. Our team of experts work to continually re-evaluate the reviews and information we provide on all the top Forex / CFD brokerages featured here.

These mobile platforms have all of the functionality of the other platform types and are very easily accessible to traders. On the other hand, the Amazing Trader is a charting algorithmic platform for FX, indices, cryptos and metals, adding to the diversity of platforms Eightcap offers. In addition to built-in risk management, you can also try the platform for free using their 28-day success program. The three main trading platforms are available on desktop and mobile while only MT5 and TradingView are also available as a WebTrader. Eightcap offers a smaller range of 40 Forex pairs, but where the Australian broker stands out is in its crypto and stock offering, with over 250 Cryptocurrencies and 400 stocks available, to trade.

The best Canadian forex brokers include Avatrade, OANDA, and Interactive Brokers. These three offer a safe and optimal trading environment for Canada-based forex traders. Similar to other brokers, Forex.com incorporate their fee into the spread. As a result, these spreads tend to be extremely tight on the Standard account – as low as 1 pip on EUR/USD. Forex.com does not charge any commissions on this account; however, you will have to pay a transaction fee if you open a commission or an STP pro account.

Forex.com also do not charge a monthly account fee – although they do charge a small inactivity fee after one year of no trading. The volume of choice of markets and accounts may be overwhelming for beginner traders. Users can access live support via telephone, email and live chat 24 hours a day, 5 days a week.

Canada may not be famous as a country of origin for the biggest Forex brokers, but, nevertheless, it is a chosen location for offices of some foreign exchange companies. Strict regulatory environment makes Canada an attractive jurisdiction to brokers that value safety of funds and reduced risks for traders. Here you will find a list of brokers that either chose to open an office in this country, were founded here, or are regulated or registered with IIROC, FINTRAC, or OBSI. Canadian Forex brokers are open to residents of almost every country in the world.

0 comentarios